Why Markets Can Supply Only Private Goods Efficiently

Goods that are nonexcludable suffer from the free-rider problem: individuals have no incentive to pay for their own consumption and instead will take a “free ride” on anyone who does pay.

Public Goods

A public good is both nonexcludable and nonrival in consumption.

Here are some other examples of public goods:

Ø ■ Disease prevention. When doctors act to stamp out the beginnings of an epidemic before it can spread, they protect people around the world.

Ø ■ National defense. A strong military protects all citizens.

Ø ■ Scientific research. More knowledge benefits everyone.

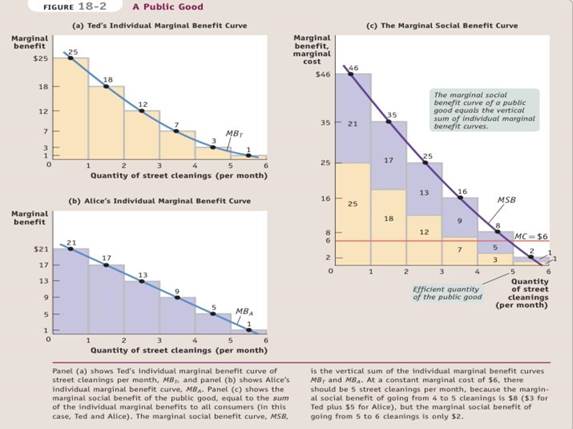

Figure 18-2 illustrates the efficient provision of a public good, showing three marginal benefit curves.

Cost-Benefit Analysis

Governments engage in cost-benefit analysis when they estimate the social costs and social benefits of providing a public good.

Common Resources

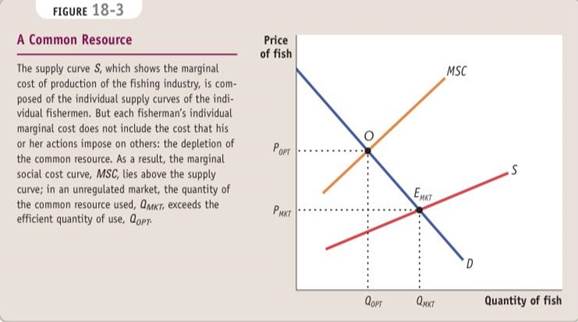

A common resource is nonexcludable and rival in consumption: you can’t stop me from consuming the good, and more consumption by me means less of the good available for you.

The Problem of Overuse

Common resources left to the market suffer from overuse: individuals ignore the fact that their use depletes the amount of the resource remaining for others.

The Efficient Use and Maintenance of a Common Resource

There are three fundamental ways to induce people who use common resources to internalize the costs they impose on others.

v ■ Tax or otherwise regulate the use of the common resource

v ■ Create a system of tradable licenses for the right to use the common resource

v ■ Make the common resource excludable and assign property rights to some individuals

Artificially Scarce Goods

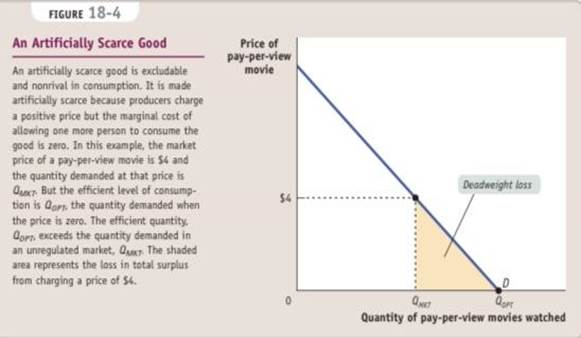

An artificially scarce good is exclud- able but nonrival in consumption.

Chapter 19

The Economics of the Welfare State

The welfare state is the collection of government programs designed to alleviate economic hardship.

A government transfer is a government payment to an individual or a family.

A poverty program is a government program designed to aid the poor.

A social insurance program is a government program designed to provide protection against unpredictable financial distress.

The poverty threshold is the annual income below which a family is officially considered poor.

|

|

|

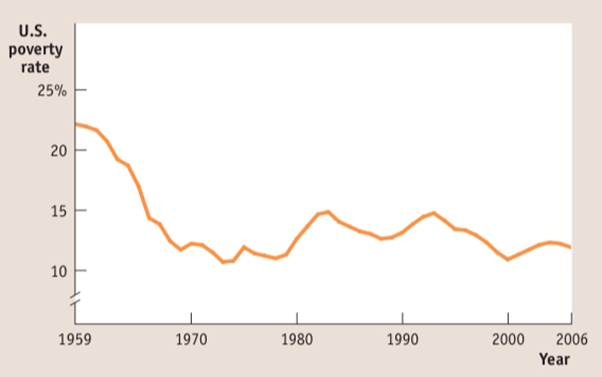

The poverty rate is the percentage of the population with incomes below the poverty threshold.

Mean household income is the average income across all households.

Median household income is the income of the household lying at the exact middle of the income distribution.

The Gini coefficient is a number that summarizes a country’s level of income inequality based on how unequally income is distributed across quintiles.

The United States has seen declining and increasing income inequality. Since 1980 income inequality

in the United State has increased substantially, largely due to an increase in inequality among highly educated workers.

A means-tested program is a program available only to individuals or families whose incomes fall below a certain level.

An in-kind benefit is a benefit given in the form of goods or services.

A negative income tax is a program that supplements the income of low-income working families.

Social Security, the largest program in the U.S. welfare state, is a non- means-tested program that provides retirement income for the elderly. It provides a significant share of the income of most elderly Americans. Unemployment insurance is also a key social insurance program.

The American welfare state is redistributive. It increases the share of income going to the poorest 60% while reducing the share going to the richest 20%.

|

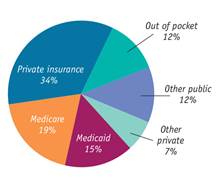

Under private health insurance, each member of a large pool of individuals pays a fixed amount to a private company that agrees to pay most of the medical expenses of the pool’s members.

The majority of Americans not covered by private insurance are covered by Medicare, which is non-means-tested and applies only to those age 65 and older, and Medicaid, which is available based on income.

A single-payer system is a health care system in which the government is the principal payer of medical bills funded through taxes.

Intense debate on the size of the welfare state centers on philosophy and on equity-versus-efficiency concerns. The high marginal tax rates needed to finance an extensive welfare state can reduce the incentive to work. Holding down the cost of the welfare state by means-testing can also cause inefficiency through notches that create high effective marginal tax rates for benefit recipients.

|

|

|

Politics is often depicted as an opposition between left and right; in the modern United States, that division mainly involves disagreement over the appropriate size of the welfare

state.

Chapter 20

Physical capital – consist of manufactured productive resources such as equipment, buildings, tools, and machines.

Human capital is the improvement in labour created by education and knowledge that is embodied in the workforce.

The factor distribution of income is the division of total income among labor, land, and capital.

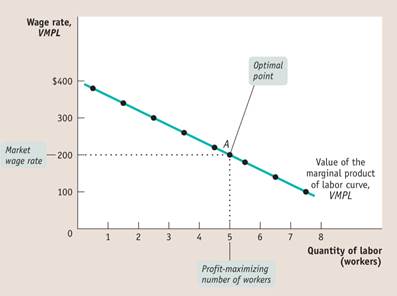

In a perfectly competitive market economy, the price of the good multiplied by the marginal product labor is equal to the value of the marginal product of labor: VMPL = P × MPL. A profit-maximizing producer hires labor up to the point at which the value of the marginal product of labor is equal to the wage rate: VMPL = W. The value of the marginal product of labor curve slopes downward due to diminish- ing returns to labor in production.

The value of the marginal product of a factor is the value of the additional output generated by employing one more unit of that factor.

The value of the marginal product curve of a factor shows how the value of the marginal product of that factor depends on the quantity of the factor employed.

The market demand curve for labor is the horizontal sum of all the individual demand curves of producers in that market.

There are three main aspects that causes factor demand curves to shift:

1) Changes in prices of goods

2) Changes in supply of other factors

3) Changes in technology

As in the case of labor, producers will employ land or capital until the point at which its value of the marginal product is equal to its rental rate. According to the marginal productivity theory of income distribution, in a perfectly competitive economy each factor of production is paid its equilibrium value of the marginal product.

|

|

|

The equilibrium value of the marginal product of a factor is the additional value produced by the last unit of that factor employed in the factor market as a whole.

The rental rate of either land or capital is the cost, explicit or implicit, of using a unit of that asset for a given period of time.

Existing large disparities in wages both among individuals and across groups lead some to question the marginal productivity theory of income distribution.

Compensating differentials, as well as differences in the values of the marginal products of workers that arise from differences in talent, job experience, and human capital, account for some wage disparities.

Market power, in the form of unions or collective action by employers, as well as the efficiency-wage model, also explain how some wage disparities arise.

Discrimination has historically been a major factor in wage disparities. Market competition tends to work against discrimination.

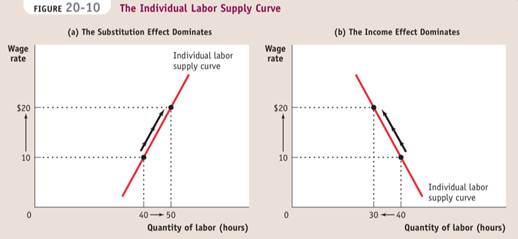

The choice of how much labor to supply is a problem of time allocation: a choice between work and leisure.

A rise in the wage rate causes both an income and a substitution effect on an individual's labor supply. The substitution effect of a higher wage rate induces longer work hours, other things equal. This is countered by the income effect: higher income leads to a higher demand for leisure, a normal good. If the income effect dominates, a rise in the wage rate can actually cause the individual labor supply curve to 66 slope the "wrong" way: downward.

The market labor supply curve is the horizontal sum of the individual labor supply curves of all workers in that market. It shifts for four main reasons: changes in prefer ences and social norms, changes in population, changes in opportuni ties, and changes in wealth.

Дата добавления: 2021-07-19; просмотров: 80; Мы поможем в написании вашей работы! |

Мы поможем в написании ваших работ!